Rates

Click here for rating search information

Rates Rebate Scheme

The Rates Rebate Scheme provides a subsidy for low-income homeowners on the cost of their rates.

Residents may be eligible if they are on low income, paying rates on the address that they were living at and their name is on the council's rating information database.

Even if your income exceeds the income threshold, you may still be eligible, depending on the amount of the rates you pay and number of dependents.

A quick way to check your eligibility is to visit www.ratesrebates.govt.nz and use their online rebate calculator. Once you've checked your eligibility, you'll can complete their application form

You will need to fill in your total income, number of dependants and your total Ashburton District Council rates. You can access your rates through our Rating search

If you think you may be eligible please contact Council on 307 7700 and discuss it with one of our Customer Service Officers.

Ashburton District Council has a Rates Postponement Scheme for homeowners aged 65 and over. Under the scheme, homeowners have the option of postponing payment of all or a portion of their rates.

This means that they have a choice of carrying on paying their rates or leave them to their estate to take care of.

Download our Rates Postponement Scheme brochure to learn more

Rates remissions may be available to properties owned and used by not-for-profit community or sports organisations that, in the Council's opinion, provide a significant public good by their use of the land.

If you are facing hardship and will struggle to pay your last rates instalment by 20 May, you can apply for the late fees to be waived via this form.

What are rates?

Rates are one of Council's key revenue tools and help pay for the range of services and facilities provided by Council.

Rates are a charge against a property and are made up of a variety of different types of rates for the variety of services provided by Council.

These include:

| General rate | Uniform annual general charge |

| Targeted rate | Roading rate |

General rate

The general rate is used to fund services that all residents are able to access relatively equally and where impact on property or ability to pay are considered an important aspect. Calculated on the capital value of your property, general rates are paid by all ratepayers. The services provided by these payments include parks and open spaces, civil defence, community services.

Uniform annual general charge

The uniform annual general charge is used to fund services that all residents are able to access relatively equally. Every property pays the same amount, regardless of the value of the property. Examples of services funded in this way include the EA Networks Centre.

Targeted rate

Targeted rates are used to fund services which only some residents are able to receive. These may be either a uniform annual charge (every property paying the rate pays the same amount) or calculated on the capital value of the property. Targeted rates are used to ensure only those receiving the service help pay for it. Examples of services funded from this type of rate include water and wastewater and amenity rates

Roading rate

Calculated the same way as the general rate but rated separated to clearly show Council's share of the costs of maintaining the district's roads.

How do I pay my rates?

Rates Easypay

Rates Easypay is the best way to pay your rates and ensure that a payment is never missed. With Rates Easypay, a direct debit payment is set up through your bank.

Direct debits can be made weekly, fortnightly, monthly or quarterly to suit your budget. If your rates change, your payment is adjusted automatically. Council will inform you in advance of any change and you will receive a rates invoice for your records.

Setting up your rates payment is easy. Simply fill in the secure online form here or download and complete the Rates Easypay form and send it to:

Direct Debit team

Ashburton District Council

PO Box 94

Ashburton 7740

Online payment

You can make your payment through the Ashburton District Council website.

Internet banking transfer

You can also make an online payment for your rates through your bank.

Please make your payment to:

Bank Account Name: Ashburton District Council

Bank Account Number: 03-1592-0521970-000

Here is some information on how to make a payment:

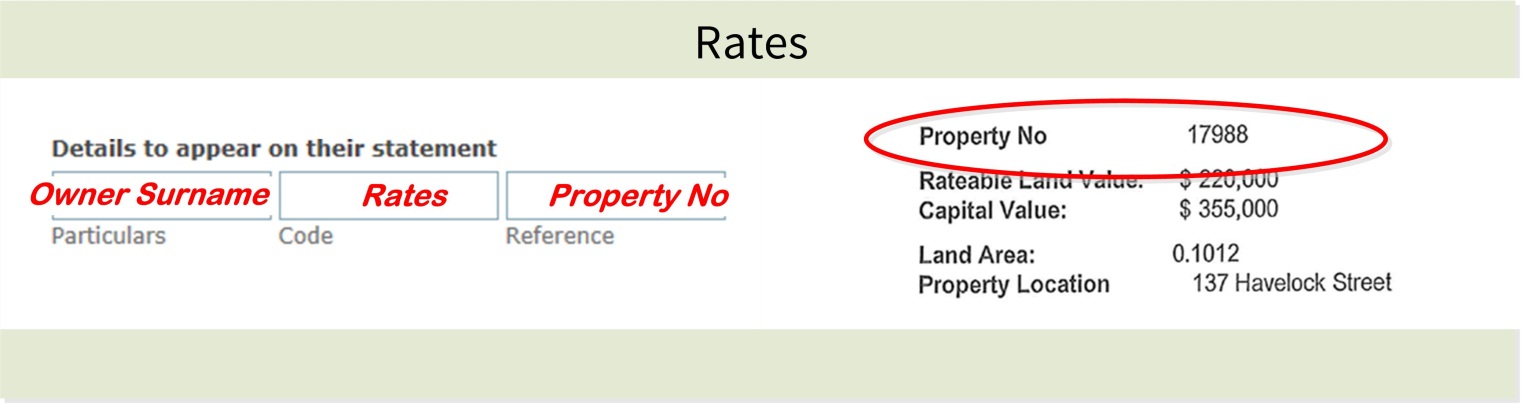

When making an online payment for rates, enter the correct information in each of the 3 fields your bank provides. You can find your property number on your rates invoice.

In person

You can visit the council to make a payment by cash, credit card or eftpos at Ashburton District Council office, 2 Baring Square East, Ashburton.

Instalment due dates

You can pay your full years rates at the beginning of the financial year or you can spread your rates across the year and pay an instalment every 3 months (quarterly).

If you are paying in instalments the payments are due by 5pm on the due dates below:

| Instalment | Payment due date |

|---|---|

| Instalment 1 | 20 August |

| Instalment 2 | 20 November |

| Instalment 3 | 20 February |

| Instalment 4 | 20 May |

Receiving rates invoices by email

Ratepayers now have the option of getting their rates invoices sent to an email address instead of in the post.

If you want to receive your rates invoices via email:

- Go to the registration web form and register with your name, property number(s), email address and phone number.

- The Council will verify your details within 10 working days.

- You will receive a confirmation email when the process is complete.

Only one email address can be registered for a property. Please note that it will be your responsibility to notify Council if your email address changes.

If you do not register for this service, you will continue receiving invoices in the post as usual.

Rating Units in Common Ownership (Contiguous)

If you have two or more rating units that are owned by exactly the same owner/s, are contiguous (share a boundary) and are used jointly as a single unit, you may qualify for contiguous rating. This means that the Council would treat them as if they were one single rating unit, for rating assessment purposes.

Contact our team on 307 7700 to learn more or find the application form here.

If the Council has not received full payment for due rates by the due date a 10% penalty will be incurred on any balance of a rates instalment that is not paid by the due date specified on the invoice.

A further 10% penalty will be incurred in July each year for any balance that remains unpaid from the previous year.

Rates Easypay is the best way to avoid rates penalties.

Please contact Council if you have not received the latest rates invoice as not receiving the account will not entitle you to a penalty remission.